Community Commitment

We proudly serve the Midwest region offering financial services to help individuals, families, and businesses succeed. From the neighborhoods of St. Louis to the towns in surrounding counties, we are dedicated to supporting the communities that make this area unique. Explore the communities we serve and see how we make a difference.

Our purpose is to help our regional communities thrive.

At Midwest BankCentre, everything we do is for the betterment of the communities we serve, from where we place our branches to where we place capital. We intentionally reinvest deposits as loans to build up underserved neighborhoods through community and economic development. We believe that access to opportunity and reasonably priced capital is a right everyone should have, and we are committed to making it happen in our region.

Volunteer work

Giving Back Through Service

Our team members share a passion for serving our neighbors, both on and off the clock. Our team volunteers more than 2,500 hours annually, and more than 50 staff members serve on more than 80 local nonprofit boards. We also offer free financial education events in local communities to help more people take control of their financial futures.

Giving joy

Connecting with Communities Through Cash & Kindness

The Give Joy program began in 2018 as a way for employees to go out into the communities we serve and make meaningful connections with people. Today, nearly 1,000 people a year receive gifts as part of the program. For some, these small acts of generosity make a big difference. For all, they bring big smiles and brighter days. Our hope is that this program inspires people to keep spreading joy in our communities. Neighbors lifting up neighbors, so we all RISE TOGETHER.

DAVID VS. GOLIATH

Community banks drive prosperity at the local level.

Challenging the idea that “Bigger is Better” when it comes to banking, Midwest BankCentre Chairman & CEO Orvin Kimbrough explains why community banks are best positioned to support communities like St. Louis. He will also uncover the risks of “banking” with online giants like Facebook and Google.

Orvin further explores this topic in a series of blog posts that challenge the myth that bigger is better and explores the risks unwary customers face when they put their money in a financial institution that is not backed by the U.S. Treasury.

Every dollar circulates 6x in our regional economy.

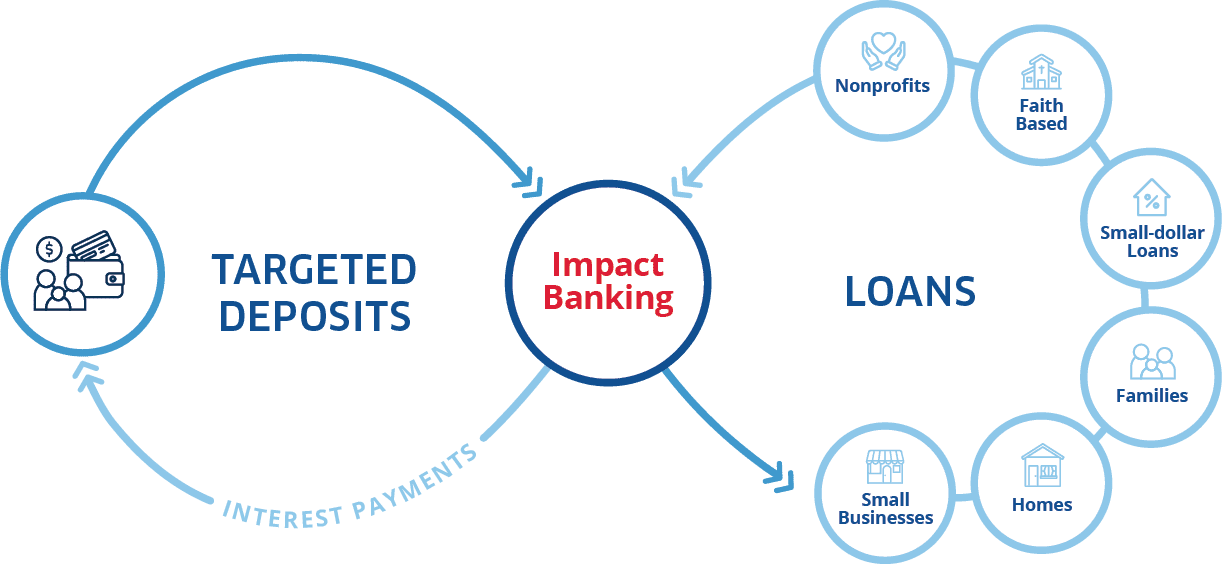

Impact Banking creates a shared risk model. Depositors choose to accept a bit less financial return to allow community-focused banks like Midwest BankCentre to take on a bit more risk in extending capital to the most under-resourced.

$200 Million Commitment

In early 2021, Midwest BankCentre made a commitment to lend an incremental $200 million to nonprofits, faith-based institutions, community development projects, and small businesses in or benefiting historically disinvested neighborhoods over the next five years. We invest a considerable amount of time and resources working through challenges that unfortunately aren’t just surface-level complexities. They are deeply rooted, systemically rooted, with the result being the exclusion of individuals and communities from accessing reasonably priced capital.

To reach its original commitment of an incremental $200 million in loans, Midwest BankCentre will need to originate a total of $495 million over the five-year period. We are proud that we are successfully tracking to our goal and are being responsibly transparent with our stakeholders about our successes, as well as the systemic challenges that we continue to face in helping more people in these communities gain access to opportunity and reasonably priced capital.”

Midwest BankCentre’s Community Impact & Annual Reports

2024 Community Impact Report

wp-content/uploads/2025/03/2024-Community-Impact-Report.pdf2023 Community Impact Report

2022 Community Impact Report

2021 Community Impact Report

Our Latest Posts

Stay updated with the latest news and announcements from Midwest BankCentre. Here, you’ll find information on our community initiatives, services, and important updates about our branches and offerings.

-

The Foundation of Banking: Lasting Relationships

The Foundation of Banking: Lasting Relationships In the dynamic world of banking, where trends shift… Read More

-

When Purpose Calls: Leading Through Talent Transitions

When Purpose Calls: Leading Through Talent Transitions One of the hardest truths in leadership is… Read More

-

How do I choose a banker?

The key elements to a great banking relationship can be summed up in three words:… Read More

Discover the power of banking local.

By choosing Midwest BankCentre, you gain a financial partner you can rely on. Plus, your funds stay local, contributing to the growth and prosperity of the region.