Why an SBA Loan?

Designed to enhance cash flow and conserve capital, SBA loans help you acquire businesses, secure funding for equipment or expansion, acquire commercial real estate, and more. They offer longer repayment terms, lower down payments, and an easier qualification process than most conventional loans.

A Responsive Banking Partner to Help You Grow Your Business

Our dedicated SBA specialists support more than 10,000 businesses and nonprofits through loans, deposit accounts, and treasury management services. They are ready to provide game-changing assistance, applying years of experience to help you secure the funds you need.

Hakim Kassam, SVP / Director of SBA Lending

(954) 292-9293

Midwest BankCentre is proud to be an SBA Preferred Lender

- Preferred lenders have the ability and authority to approve small business loan requests in-house, without requesting approval from the SBA. This cuts the approval time drastically and offers a much more streamlined business process.

- Preferred lenders can offer loans that are guaranteed for up to 90 percent of $5 million. They offer borrowers who qualify more options, giving them greater freedom in their loan requests. These types of loan requests include purchasing or refinancing owner-occupied real estate, business acquisition loans, construction loans, debt refinances, partner buyouts, and working capital.

- Preferred lenders offer small business owners the ability to acquire a business with as little as 10 percent down.

- Preferred lenders usually offer market interest rates and repayment terms from seven to 25 years and no prepayment penalties on loans under 15 years, and these loans are also assumable (with qualification).

- Preferred lenders are reputable and have a proven track record since they have an ongoing relationship with the SBA.

Why We Rise Above the Competition

Quick Responses

|

Coordinated Efforts

|

Customized Solutions

|

Experience You Can Trust

|

| We provide local service with a dedicated relationship manager, not a 1-800 number. Our experts are standing by to help you and your business. |

With lending, treasury, and retail under one roof, you benefit from efficient efforts that maximize your yield from your banking operations. |

We personalize our banking solutions for each and every customer, offering a comprehensive list of products that meet your business needs.

|

Our team of dedicated SBA specialists are ready to assist small business owners as their trusted advisors. They apply their years of expertise to help small business owners navigate the SBA programs to secure the funding they need to grow their business. |

How to Choose a SBA Lender

There are over 2,500 active SBA lenders in the country and the product is identical across lenders. If you are considering who to apply for your SBA loan with, you might want to consider:

- Local Decision Making: Your loan is reviewed with the decision-makers

- Working With Lenders That Know Your Market: You bank where you live. The intangible benefits go above and beyond the typical 5 cs of credit.

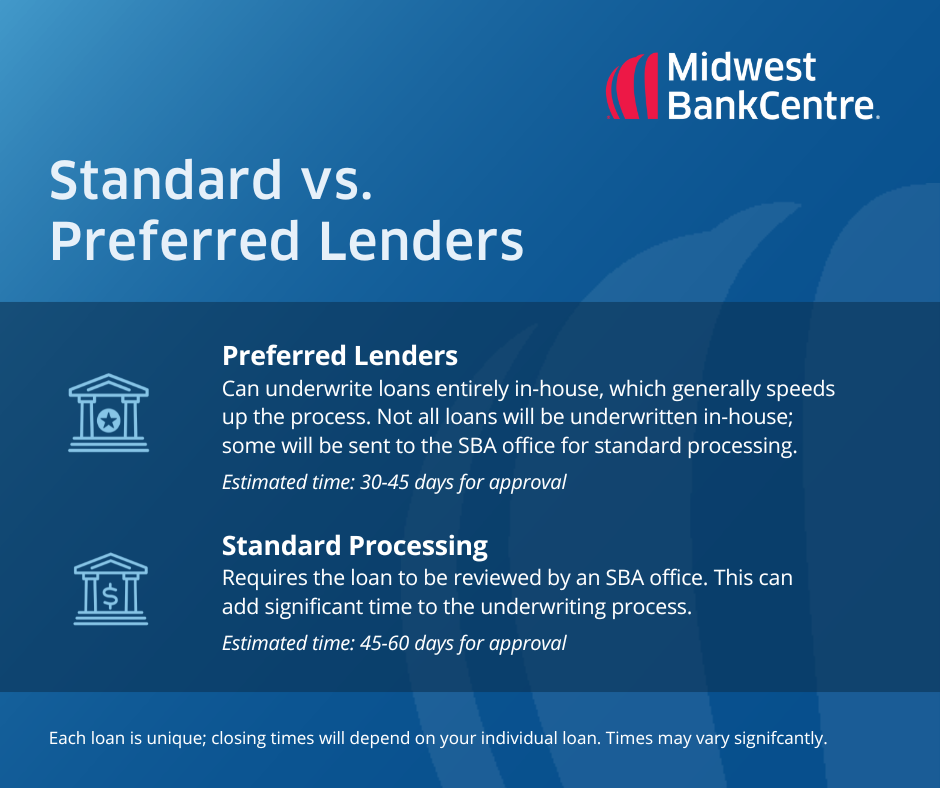

- Preferred Lender Status: A Preferred SBA Lender can underwrite loans entirely in-house, which generally streamlines and speeds up the process. Average closings can range from 75-90 days to 45-60 days.

Your lender's goal should be to expedite the SBA loan process to provide faster access to competitively priced capital, helping to spur small business growth. The time is ripe for small businesses to take advantage of government-backed programs that help small businesses tackle perennial challenges, particularly as the economy expands post-pandemic.

SBA Loans with Midwest BankCentre

| SBA 7(a) Loan |

SBA 504 Loan |

- Designed for businesses looking to acquire an existing business, buy-out a partner, expand to another location, purchase real estate or equipment, or those looking to combine any of these needs in one loan.

- Appropriate for longer-term financing for businesses with net worth below $15 million and an average net income below $5 million.

- Terms are up to 25 years for commercial real estate and up to 10 years for all other purposes.

Interest rates can be either fixed or variable

|

- Designed for businesses looking to expand through land or building acquisition, construction, or equipment purchase.

- Appropriate for longer-term financing for businesses with net worth below $15 million and an average net income below $5 million.

- Loan amount is up to $7,000,000 for the Midwest BankCentre portion and up to $5,000,000 for the portion funded by a Certified Development Company.

- Terms are up to 25 years for commercial real estate and up to 10 years for machinery or equipment.

SBA Loan Interest rates can be either fixed or variable.

|

| SBA Express Loan |

|

|

Receive business financing faster with an SBA Express Loan. This quicker version of the SBA 7(a) loan provides SBA financing for the business owner that needs fast funding. Here is what you need to know about this SBA loan program:

-

Faster Approvals - As quick as 36 hours from submission of loan application

-

$500,000 Maximum Loan Amount

-

Interest Rates Cannot exceed SBA Loan Interest Rates Max

-

Rates and Eligibility Determined by SBA Preferred Lender

-

Up to 50% guaranteed by SBA

|

Let One Of Our SBA Specialists Help You Find The Financing Option That Is Right For You

Hakim Kassam, SVP / Director of SBA Lending